Elevating Dubai’s Aerospace Landscape: A Conversation with Tahnoon Saif, CEO of Mohammed bin Rashid Aerospace Hub at Dubai South

This article was published on: April24,2024 11:21 AM

Exploring the Boundless Opportunities and Growth Trajectory of Dubai’s Aerospace Hub By:Poonam Chawla Aviation Guide explores the thriving hub of aviation excellence at Mohammed bin Rashid Aerospace Hub (MBRAH), nestled within the vibrant landscape of Dubai South. In this exclusive interview, Tahnoon Saif, the dynamic CEO of MBRAH, unravels the secrets behind the phenomenal rise in privateRead More

Bombardier Sets New Environmental Standard with Full EPD Suite for In-Production Aircraft

This article was published on: April24,2024 3:15 AM

Bombardier paved new ground in the business jet sector with the initial EPD it secured for the Global 7500 in 2020. The EPD was developed through the International EPD System, which has a library of declarations for products from more than 30 countries in an attempt to foster transparency about environmental life cycles. Third-party verifiedRead More

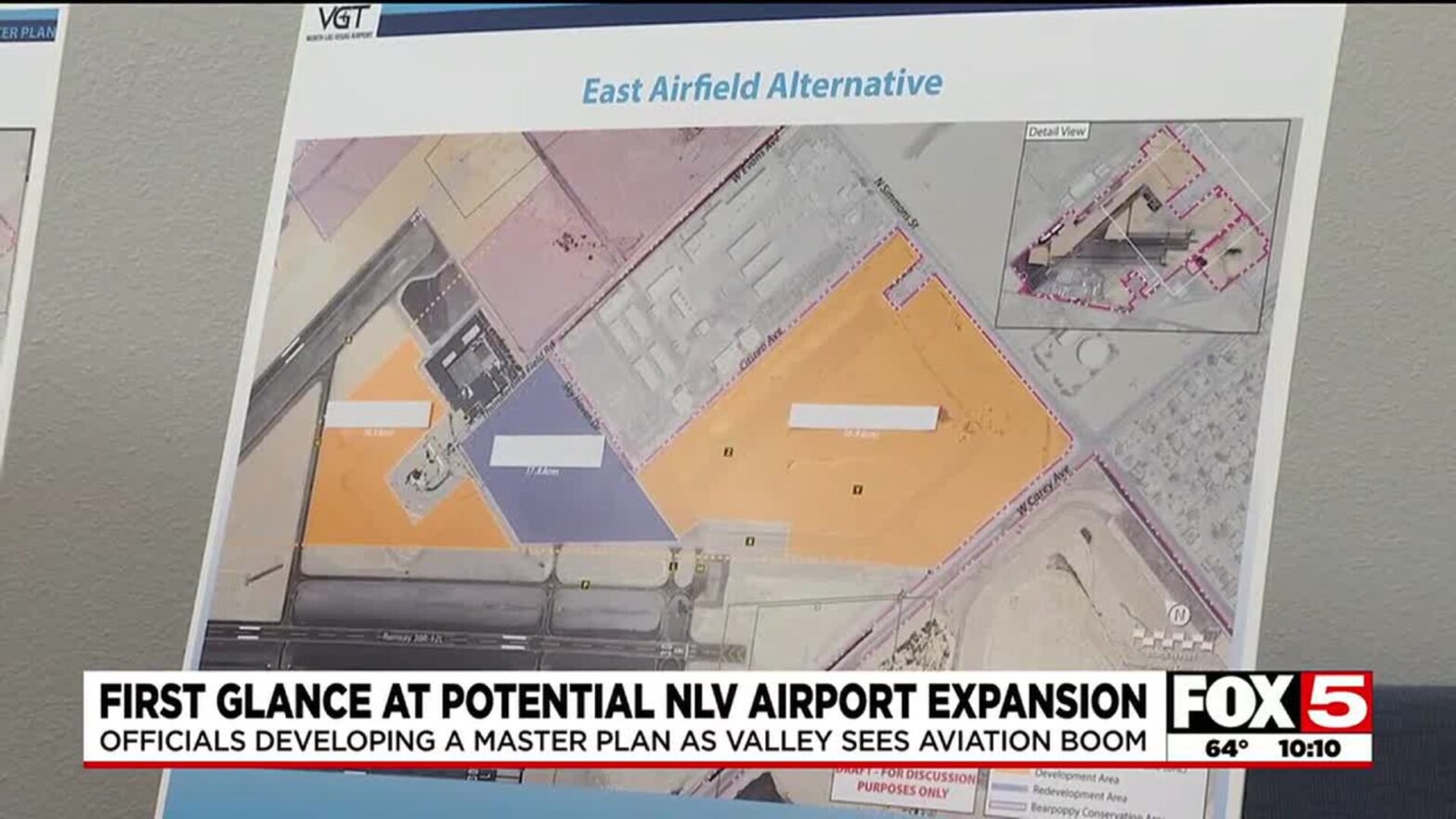

Future Growth Mapped Out: North Las Vegas Airport Expansion Revealed

This article was published on: April23,2024 3:13 AM

A public information workshop held recently outlined future expansion plans for North Las Vegas Airport (KVGT). The meeting in the general aviation airport’s terminal was chaired by Eric Pfeifer, the senior planner and project manager at Coffman Associates, the consulting company chosen for the project. In cooperation with the FAA and Clark County Department ofRead More

Rolls-Royce Launches Flight Test Campaign for Pearl 10X Engine

This article was published on: April22,2024 3:11 AM

Rolls-Royce has kicked off the flight test campaign for its latest aero engine for the business aviation market, the Pearl 10X. The test took place on the company’s dedicated Boeing 747 flying testbed. The engine has been selected by French aircraft manufacturer Dassault to exclusively power its brand-new flagship aircraft, the Falcon 10X. The start ofRead More

DC Aviation Al-Futtaim (DCAF): Redefining Luxury and Efficiency in Dubai’s Aviation Sector

This article was published on: April7,2024 9:44 AM

DCAF VIP Terminal is elevating Dubai’s Aviation Landscape with Unmatched Luxury and Efficiency. Managing Operations for 11 Aircraft at Al Maktoum International. Dubai’s aviation scene thrives on innovation and excellence, with DC Aviation Al-Futtaim VIP Terminal (DCAF) emerging as a prominent force in this dynamic industry. The collaboration between Germany’s DC Aviation GmbH and Dubai’sRead More

EAMRO 2024: Elevating Aviation MRO excellence beyond boundaries

This article was published on: April3,2024 10:00 AM

The 3rd edition of Emerging trends in MRO Industry [EAMRO 2024] was organized on March 29, 2024, at Seminar Hall, Indian Institute Technology Delhi [IIT Delhi]. The event was flagged off by a mesmerizing cultural performance by renowned classical dancer, Ms. Arunima Ghosh. The conference was inaugurated by the Chief Guest Lt. Gen. Ajay KumarRead More

Innovative Solution: AEM’s Bespoke Kit Processing Software Ensures Precision in Aircraft Medical Kit Maintenance

This article was published on: March29,2024 3:59 AM

Ametek MRO AEM is tracking thousands of aircraft medical kit parts using a bespoke kit processing software developed by its Aeromedic division. Essentially, this tracks the expiration date and batch number of every first aid component in the kits. The bespoke system was developed solely by AEM with a specialist IT developer and integrates withRead More

Tryst, IIT-Delhi and Aviakul Group of Companies join hands to organize 3rd edition of EAMRO

This article was published on: March28,2024 7:03 AM

The 3rd edition of “Emerging Trends in Aviation MRO Industry” (EAMRO’24) is scheduled to take place on 29th March, 2024 at Seminar Hall, IIT Delhi. After successful conduction of 1st edition at National Institute of Technology (NIT), Delhi and 2nd edition at Indian Aviation Academy (IAA), Delhi- this edition promises to be bigger and better.Read More