DC Aviation Al-Futtaim (DCAF): Redefining Luxury and Efficiency in Dubai’s Aviation Sector

This article was published on: April7,2024 9:44 AM

DCAF VIP Terminal is elevating Dubai’s Aviation Landscape with Unmatched Luxury and Efficiency. Managing Operations for 11 Aircraft at Al Maktoum International. Dubai’s aviation scene thrives on innovation and excellence, with DC Aviation Al-Futtaim VIP Terminal (DCAF) emerging as a prominent force in this dynamic industry. The collaboration between Germany’s DC Aviation GmbH and Dubai’sRead More

EAMRO 2024: Elevating Aviation MRO excellence beyond boundaries

This article was published on: April3,2024 10:00 AM

The 3rd edition of Emerging trends in MRO Industry [EAMRO 2024] was organized on March 29, 2024, at Seminar Hall, Indian Institute Technology Delhi [IIT Delhi]. The event was flagged off by a mesmerizing cultural performance by renowned classical dancer, Ms. Arunima Ghosh. The conference was inaugurated by the Chief Guest Lt. Gen. Ajay KumarRead More

Innovative Solution: AEM’s Bespoke Kit Processing Software Ensures Precision in Aircraft Medical Kit Maintenance

This article was published on: March29,2024 3:59 AM

Ametek MRO AEM is tracking thousands of aircraft medical kit parts using a bespoke kit processing software developed by its Aeromedic division. Essentially, this tracks the expiration date and batch number of every first aid component in the kits. The bespoke system was developed solely by AEM with a specialist IT developer and integrates withRead More

Tryst, IIT-Delhi and Aviakul Group of Companies join hands to organize 3rd edition of EAMRO

This article was published on: March28,2024 7:03 AM

The 3rd edition of “Emerging Trends in Aviation MRO Industry” (EAMRO’24) is scheduled to take place on 29th March, 2024 at Seminar Hall, IIT Delhi. After successful conduction of 1st edition at National Institute of Technology (NIT), Delhi and 2nd edition at Indian Aviation Academy (IAA), Delhi- this edition promises to be bigger and better.Read More

Nigerian Carrier Ibom Air Plans to Become Leading MRO Facility in Africa

This article was published on: March28,2024 3:58 AM

Nigerian carrier Ibom Air is looking to establish itself an MRO provider for the African continent, mirroring the likes of EgyptAir, Ethiopian Airlines and Kenya Airways. Ibom Air, which has historically been a Bombardier CRJ900 operator, is a regional-government owned airline that launched operations in June 2019. Late last year, the Uyo-based carrier received theRead More

ExecuJet Haite Expands Presence in China with New MRO Center at Daxing International

This article was published on: March27,2024 3:57 AM

China’s business jet market may have shrunk, but ExecuJet Haite’s general manager, Paul Desgrosseilliers, foresees a gradual rebound, buoyed by an uptick in overseas visitors at the company’s Tianjin facility. Now, with a second maintenance, repair, and overhaul (MRO) center at Beijing’s mega-hub, Daxing International, Desgrosseilliers is optimistic about the increased potential for growth andRead More

Boeing’s Wisk Aero and Sugar Land Collaborate on eVTOL Air Taxi Vertiport

This article was published on: March26,2024 4:13 AM

The Texas city of Sugar Land aims to be the first base in a network of eVTOL air taxi services in the Greater Houston area under plans announced last week with Wisk Aero. Recently, city officials signed a partnership with the Boeing subsidiary to select a location at Sugar Land Regional Airport for a vertiportRead More

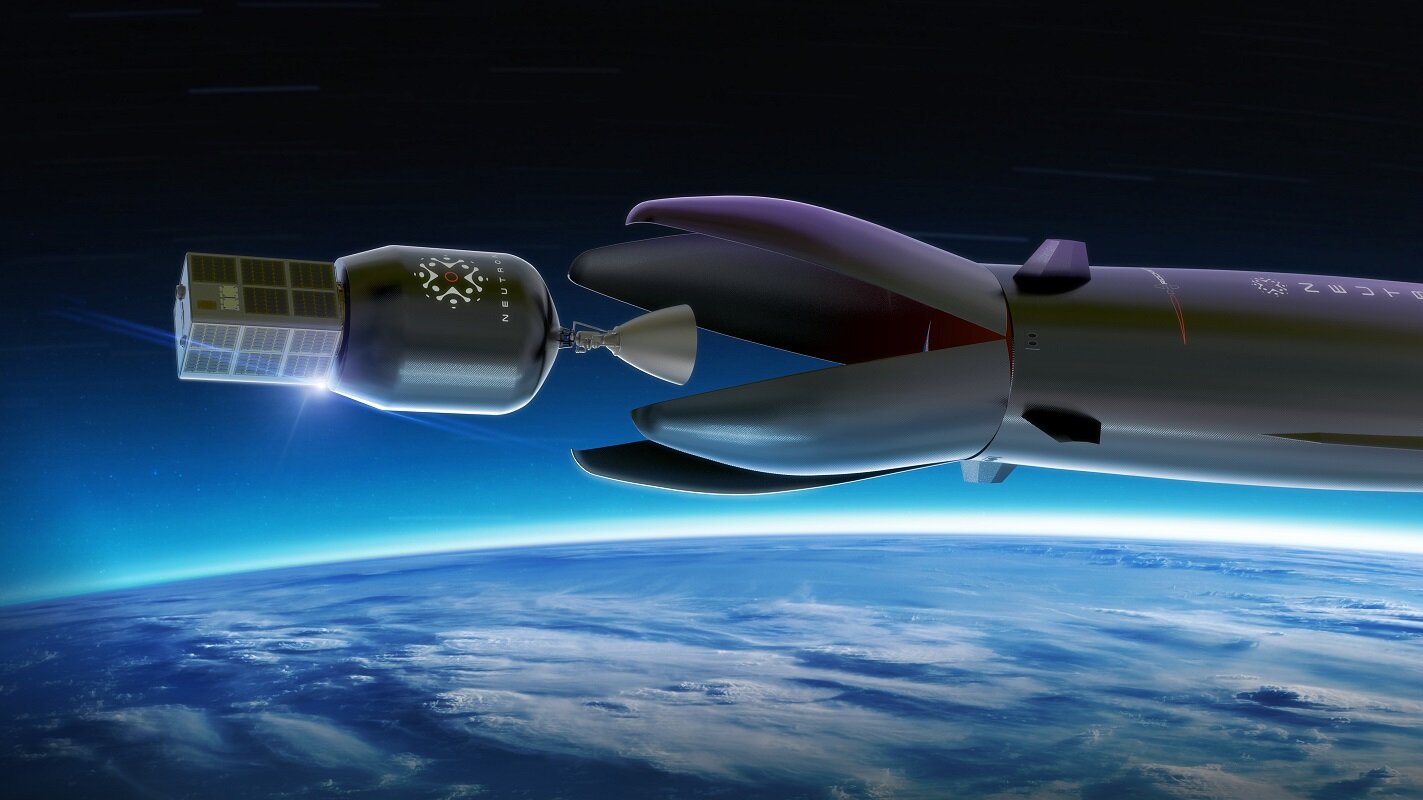

Rocket Lab Aims for Neutron Rocket Launch Before Year’s End, Reveals Long-Term Constellation Vision

This article was published on: March26,2024 3:55 AM

Rocket Lab says it could launch its first Neutron rocket before the end of the year as it outlines a long-term vision for the company that involves its own satellite constellation. In a February earnings call to discuss the company’s fourth quarter and 2023 financial results, Rocket Lab executives said development of its Neutron medium-liftRead More